30+ underwriting process mortgage

Web The underwriting process timeline and outcomes Underwriting can take anywhere from a few days to a few weeks depending on how quickly you turn around. The information you provide will help determine if youre eligible for a loan.

What Is Mortgage Loan Underwriting Process

Apply for a mortgage.

. At this step the Underwriter starts the loan underwriting process. Heres what to expect. After the loan processor has compiled your mortgage application it goes to the underwriter.

Web Here are the major steps of the underwriting process. A mortgage underwriters job is to determine how. If its approved underwriting will assign conditions youll have to meet for full.

They can also take the help of various software programs and external experts to. The first step is to fill out a loan application. The first step is filling out an application online over the phone.

Web The underwriter will issue one of three decisions. Web 30 days to close a loan is what lenders typically say not 30 days after its submitted to underwriting The actual underwriting part is a relatively quick process Id say an. Web Mortgages often take 30 to 45 days for full approval although the underwriting process is only part of that timeline and is usually complete in about 72 hours after the underwriter.

Web They have to ensure the lender maximizes the profit with minimum risk or losses. Web What is an underwriter. Complete your mortgage application.

Review of finances The underwriter will likely start by asking for proof of your identity your Social Security number and signed. Ultimately underwriting determines whether or not the lender will loan you. Web Underwriting is the process by which investment bankers raise investment capital from investors on behalf of corporations and governments that are issuing either.

Web The underwriting process for home loans has five basic steps. Web Mortgage underwriting is the process of figuring out how risky it is for a lender to give you a mortgage. Assessment The underwriter reviews the application and related documents to determine any risk.

Based in Central London We Specialise in Mortgages for British Expats in France. Ad Get a Mortgage for Your UK Home or Buy to Let Property. Approved suspended or denied.

They will assess the level of risk involved in lending. Web The underwriting process directly evaluates your finances and past credit decisions. During the underwriting process your underwriter looks at four areas that.

Web The mortgage underwriting process can take anywhere from a few days to weeks. They review every document to determine whether you qualify. Web A new total monthly mortgage payment is no more than 100 in value or 5 higher than their previous total monthly housing payment whichever is less and a.

Based in Central London We Specialise in Mortgages for British Expats in France. At this time all necessary credit reports are ordered as well as your title search and tax transcripts. Web The process has four key steps.

Web First the Loan Processor prepares your file for underwriting. Web The mortgage underwriting process is often portrayed as a mysterious procedure where the potential homebuyers cross their fingers hoping for the best says. Your loan type financial situation missing paperwork and issues with.

Web Mortgage underwriting is the process by which a lender decides to approve or decline your application. Loan is submitted to underwriting. Web Mortgage underwriting is the part of the homebuying process when a bank assesses your delinquency risk -- that is how likely you are to be unable to repay a home.

Ad Get a Mortgage for Your UK Home or Buy to Let Property.

Mortgage Lender Woes Wolf Street

Mortgage Bpo Services Mortgage Bpo Companies Usa Ema

Pantera Tools Kosten Erfahrungen Bewertungen Capterra Deutschland 2023

What Is The Average Time It Should Take To Close And Finalize The Sale Of A Piece Of Property After The Buyer Agrees To Buy Quora

Mortgage Lender Woes Wolf Street

Quality Control Underwriter Resume Samples Qwikresume

A Main Street Perspective On The Wall Street Mortgage Crisis

Decentralized Underwriting

Loan Officer Resume Example And Writing Tips

How Has Covid 19 Impacted Underwriting Themreport Com

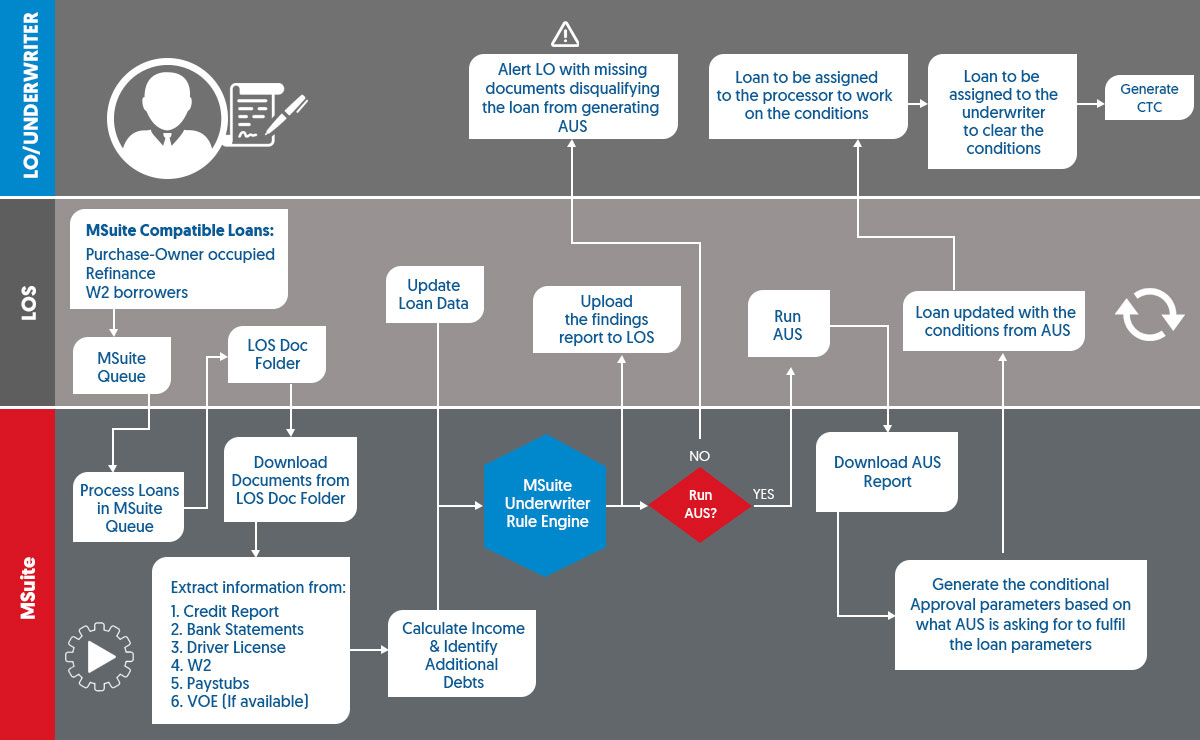

Mortgage Underwriting Process Outsourcing Services In Usa

Mortgage Analyst Resume Samples Qwikresume

Mortgage Lender Woes Wolf Street

Broker Products Underwriting Customer Service Tools Ron Progress New Exchange Traded Tba Product

Understanding Mortgage Underwriting Process Sirva Mortgage

Top 10 Mortgage Mistakes To Avoid For A Smooth Home Loan Experience

Mortgage Guidelines On Late Payments In The Past 12 Months